Ballot measure adds undue stress

Struggling community faces rate hike while fighting to be fiscally independent

Oct 29, 2014

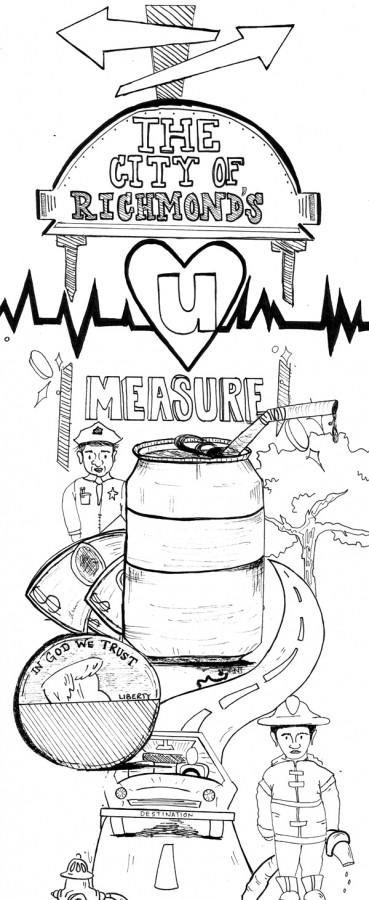

The upcoming Richmond ballot will offer Measure U to voters, which if passed will implement a half-cent sales tax increase on the city and people that have trouble affording to operate as it is.

The city of Richmond, also known to Bay Area natives as the “City of Pride and Purpose,” is filled with wonderful everyday people that have built lives upon a culturally rich foundation, not a financially rich one.

The last fiscal year for Richmond showed the cities operating a net surplus of $6,896,146 — in the red.

And while the half-cent tax increase would put a projected $1 million dent into that deficit, you should stop and ask yourself, who would be affected by this tax and how?

By taxing the people living in Richmond, the city hopes to aid financial woes.

Richmond residents will contribute 49 percent of the total revenue generated by Measure U, with Richmond business owners and non-Richmond residents making up the other 22 and 29 percent, respectively.

Now having grown up in and around the East Bay Area my whole life, let me be the first to tell you, the last thing every resident of Richmond needs is a tax increase.

Some may think that half a penny increase on anything would probably go unnoticed, but this is not true.

The average amount paid per Richmond resident would be $2.93 per month.

That comes to $35.16 a year, meaning between the 2015-16 fiscal year for Richmond, the cities residents as a whole will be charged a projected $3.7 million.

The last survey conducted in Richmond showed that the average income per capita in 2012 was $26,751 a year.

And with the cost of living steadily increasing, Measure U will add stress to the lives of Richmond residents experiencing what is for many already an extremely stressful time.

Tax increases do not seem like much of a threat when the things they can benefit are necessary.

Public facilities, hospitals and youth programs, among numerous other projects, would be potential recipients of the funds generated by Measure U.

But one has to look at the way those things are funded already — taxes.

The Richmond Council of Industries reported that two of the top three revenue sources for the 2013-14 fiscal year were the city’s sales tax and property tax, raising nearly $60 million between the two.

At some point in history the sales tax was increased to 9 percent, which is the current tax rate in Richmond.

If Measure U passes, that tax rate will increase to 9.5 percent on most items sold in the city.

Having worked in retail, it is easy to see the potential in this bill, and tax increases are not always a bad thing.

Residents of a community do have obligations to pitch in money to keep the city they live in functioning.

It is true that it takes a village to raise a child, even when that “child” is money.

But the residents of this village are already raising most of the money, so why tax them more when there are other avenues of opportunity?

Probably because it is a really easy way of generating revenue, regardless of the fact that it can do harm to those it is meant to help.