Initiative spotlights scope of budgeting, maturity

Oct 30, 2017

Often times, the struggle of financial instability goes unseen as people put out a well-kept facade or say they aren’t hungry but they haven’t eaten in 18 hours, SparkPoint Coordinator Bill Bankhead said. “They are wearing jeans and a T-shirt, but so is 80 percent of the campus. But what we don’t see is that they own one pair of jeans and a T-shirt, while other people have four pairs of jeans and 15 T-shirts.”

California Community Colleges Chancellor’s Office (CCCCO) developed the Financial Wellness Initiative to increase financial literacy among community college students. By educating students on how to manage their financial choices, people are more likely to save, invest and stay out of debt, according to the CCCCO website.

“We want to help students know, ‘You are not alone. Whatever your financial challenge is, whether it’s related to food insecurity, housing insecurity or how much debt you are in, you are not alone and there are support resources here on campus’,” Bankhead said.

Financial Aid Supervisor Monica Rodriguez said the decisions people make at an early stage in life can affect them for the rest of their lives and helping students think about money in different ways like understanding student loans and credit scores can help them. “We have a lot of first-generation college students who come from a background where financial literacy is not something they are learning at home.”

Growing up, Rodriguez said she learned through friends how to set up a bank account because at the time her parents didn’t have one. “I remember myself being a college student, when you don’t have an example on how to manage your money,” she said.

Contra Costa College Vice President Ken Sherwood said students face other factors in their daily lives other than just attending college. Based on tracking data from Achieving the Dream, a non-government reform movement for student success, the factors that create barriers for students to be successful like working a job or being parents are becoming clearer.

Sherwood said, “This (Financial Wellness Initiative) is the next step in trying to address those concerns.” The realization happened with knowing if they didn’t start to help people with their financial insecurities, food insecurities and those who are homeless, then they are not going to get more people coming to college. “If students are going to take out loans, we need to counsel them, before they take out the money, about how to use the loan money and how they are going to pay it back.”

Sherwood said communication habits have changed so much with each generation that it’s hard to know how to get information out. “I hear all the time, ‘Well, students don’t read their email.’ For us working at the college, that is our primary mode of communication. We do most of our work through email. But if students don’t read their email, that is not going to help us to educate them about financial issues.”

Rodriguez said although it is in the early stages, they are talking to campus committee members like the Student Success Committee and exchanging ideas to support students. At CCC, student resources can be found through the Associated Student Union food pantry, located in the Student and Administration Building, as well as Comet Care Packages with toothbrushes and toothpaste, shampoo and other basic necessities for students who request them in SA-227.

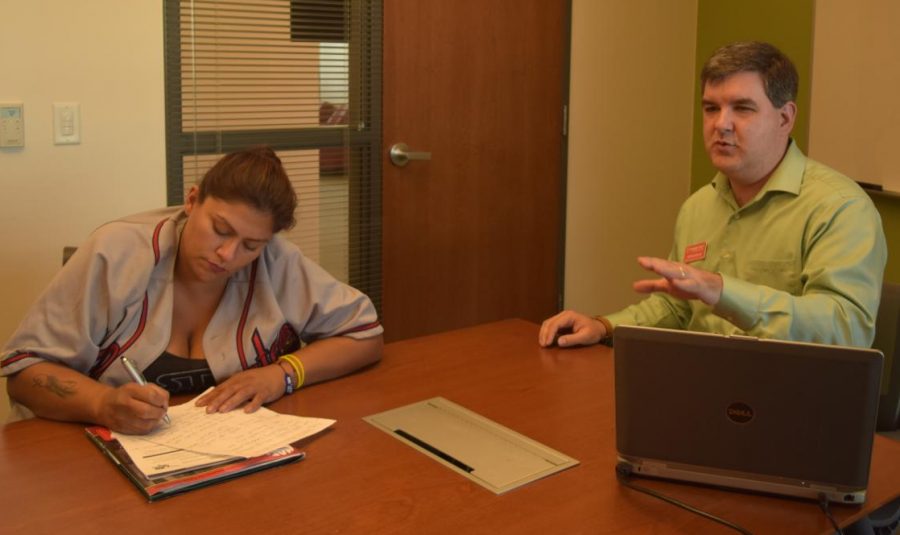

Bankhead said he offers weekly SparkPoint workshops on budgeting, credit improvement, student loan and paying off debt to help students manage money. “These resources are here. Please use them. We have food and toiletries and we want to give them to you,” he said.

By normalizing the idea is that students will feel supported and understand that financial instability is real and nothing to be ashamed of, Bankhead said they want to inform students on the necessary steps to take in order to learn to help themselves.

Rodriguez said one of the challenges is that there isn’t additional funding provided by the state to implement the initiative, which may affect the implementation of the program. “It can be difficult because things like running workshops or hosting events cost money for supplies of for offering a prize drawing.”

One of the current struggles is engaging students through workshops put on on campus, Rodriguez said. Rodriguez said the goal is to create a culture where financial literacy is “a thing” and every student understands the message.